Stock-Based Compensation

If you receive stock-based compensation – restricted stock units, incentive stock options, non-qualified stock options or employee stock purchase plans – it should be considered in your overall financial plan. Once vested, these options can be sold to create cash flow, or they can be treated as a security and included in a portfolio as part of its equity component.

What You May Be Thinking

Your advisory team factors in stock options along with all your assets when designing a portfolio. We believe in diversifying your investments, and in this case, that means not having too much of your financial future dependent on the performance of your employer or your employer’s stock (known as concentration risk). After all, your income and possibly your benefits and retirement savings plan are already tied to your employer.

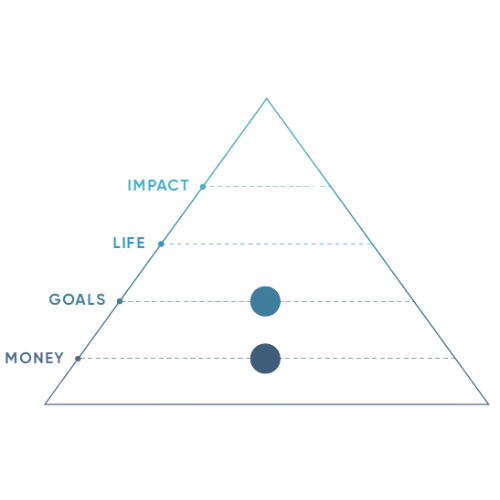

Stock-Based Compensations touches on these planning strategies used by Copper Leaf:

To mitigate this risk, we usually recommend evaluating your compensation components to understand what can be sold, when to sell and how that cash flow can be used to rebalance your portfolio so it achieves proper diversification, a hallmark of our investing approach. We guide you through the process every step of the way.

How Your Team Helps

- Review the statements you receive to help decide the best course of action.

- Assist in determining how much the stock options will be worth once vested.

- Help you decide whether and when to execute stock options and what you should do next.

- Explain how the tax treatments differ for various stock-based compensation and explore whether there are strategies you can employ to reduce taxes.

- Navigate evolving tax rules, changing income brackets, AMT considerations, and other factors across vesting periods.

Please note that the information presented in this material is for general purposes only and should not be acted upon without first seeking professional advice. This material has been authorized by Focus Partners Advisor Solutions (FPAS), and CLF makes no representation or warranty regarding the accuracy of the information provided. It is being used with permission and was originally published by FPAS.

Copper Leaf Financial has established key strategic partnerships with elite financial industry leaders including FPAS. These alliances put us in the optimum position to help clients reach their personal and financial goals while retaining our independence. We are truly independent fiduciaries offering high-level services without being accountable to a large parent corporation unlike many of our competitors who attempt to pick stocks and outsmart the market. As a member of FPAS network of more than 140 independent wealth management firms we have strengthened our ability to help clients make the best decisions by providing them with ideas, insights, and intelligence from industry thought leaders. Through our strategic partnerships we are in a unique position to deliver comprehensive solutions to our clients. This is true wealth management.

©️2024 Focus Partners Advisor Solutions.

All rights reserved. IRN-24-6693