Building Efficient Tax Strategies

Taxes can be one of the biggest expenses for investors. In fact, minimizing your tax expenses is as important as minimizing your investment management expenses, and doing so can help increase the odds of achieving your financial goals. Implementing efficient tax strategies touches nearly every corner of wealth management, from managing your investments to planning for your retirement to leaving the legacy you want.

What You May Be Thinking

- Are my retirement accounts as tax efficient as possible?

- How can I minimize the effect of taxes on my estate plan?

- How can I best marry the tax benefits I receive with my charitable giving?

- How can I stay up-to-date with the latest tax rules and regulations?

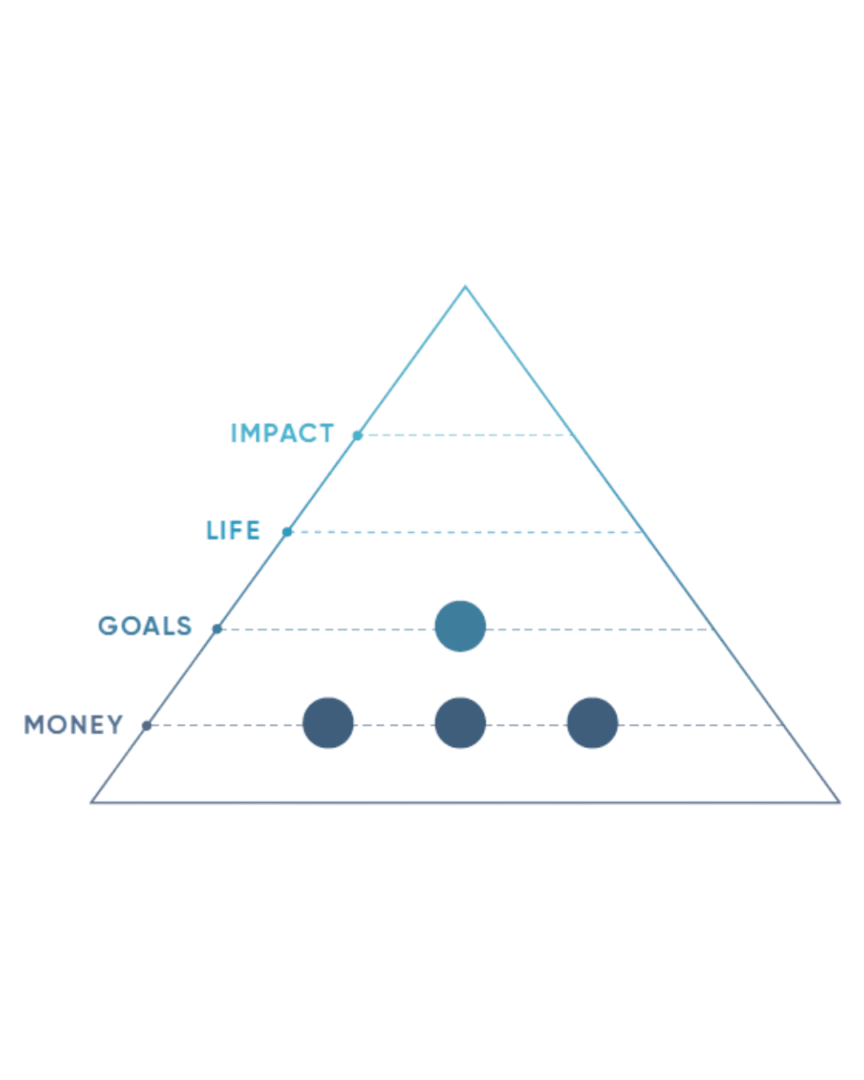

Efficient Tax Strategies are relate to these other areas of planning used by Copper Leaf:

How Your Team Helps

One pillar of evidence-driven investing is the minimization of taxes. Your advisory team continually looks for ways to implement tax-efficient strategies throughout your comprehensive wealth plans. These are some of the ways we accomplish this:

- Help you save as much as possible for retirement by analyzing the efficiency of your savings plans.

- Look for opportunities in the portfolio to offset realized capital gains and lower taxes. We do this year-round – not only at the end of year – to ensure you don’t miss out on opportunities.

- Help with optimal tax strategies for Roth conversions and choosing the most appropriate retirement savings plans, such as traditional or Roth IRAs and 401(k) plans.

- Place investments strategically across savings vehicles (taxable, tax-exempt and tax-deferred accounts) to lower your overall tax bill.

- Create and implement a plan to help increase your odds of having enough money in retirement in the most tax-efficient manner possible.

- Review tax returns in order to properly plan and be aware of any changes in tax solutions.

- Leverage the knowledge and experience of advisors who stay current on tax law changes and collaborate with practitioners in field to better serve your overall wealth management plan

Please note that the information presented in this material is for general purposes only and should not be acted upon without first seeking professional advice. This material has been authorized by Focus Partners Advisor Solutions (FPAS), and CLF makes no representation or warranty regarding the accuracy of the information provided. It is being used with permission and was originally published by FPAS.

Copper Leaf Financial has established key strategic partnerships with elite financial industry leaders including FPAS. These alliances put us in the optimum position to help clients reach their personal and financial goals while retaining our independence. We are truly independent fiduciaries offering high-level services without being accountable to a large parent corporation unlike many of our competitors who attempt to pick stocks and outsmart the market. As a member of FPAS network of more than 140 independent wealth management firms we have strengthened our ability to help clients make the best decisions by providing them with ideas, insights, and intelligence from industry thought leaders. Through our strategic partnerships we are in a unique position to deliver comprehensive solutions to our clients. This is true wealth management.

©️2024 Focus Partners Advisor Solutions. All rights reserved. IRN-24-6693