401(k) Retirement Plan Solutions for Businesses

Retirement Plan Solutions Tailored to Your Business

There are so many moving parts and decisions to be made when it comes to 401(K) retirement plans. Let us work with you to see if your:

- Retirement plan is meeting your business goals

- Employees and participants are on track to retirement readiness

- Administrative and investment fees are reasonable in relation to the services you receive

Are you in compliance? We can assist you with your fiduciary duty of periodically reviewing your plan and eliminate any concern on your part.

What we do best at Copper Leaf Financial is to simplify things for our clients. We help make their lives easier. Let us help you clear out perplexities and simplify the management of your plan.

Enjoy No Commissions and No Hidden Fees. It’s that simple. All we provide is a wealth of objective advice based on decades of independent financial research to help you make smarter choices.

A Second Opinion

We offer employers with existing retirement plans a complementary second opinion on the health of their retirement plan. This free diagnostic evaluation includes:

- An analysis of your plan’s investment expenses

- An examination of all fees and commissions paid to your plan’s service providers

- An opportunity to ask questions and receive unbiased feedback from our team of tax and retirement plan experts

This second opinion will give you peace of mind knowing that you have explored your options. You will feel confident that the consultation you receive comes from an experienced, fiduciary plan advisor who values evidence over emotion and independent advice over commissions.

Copper Leaf Financial focuses on providing the assurance that comes from knowing you’ve taken the right steps. We create customized plans that focus on:

- Easy administration

- Transparent fees

- High-quality service providers

- Professionally managed, low-cost portfolios

- Delegation of fiduciary responsibility

- Effective support and education

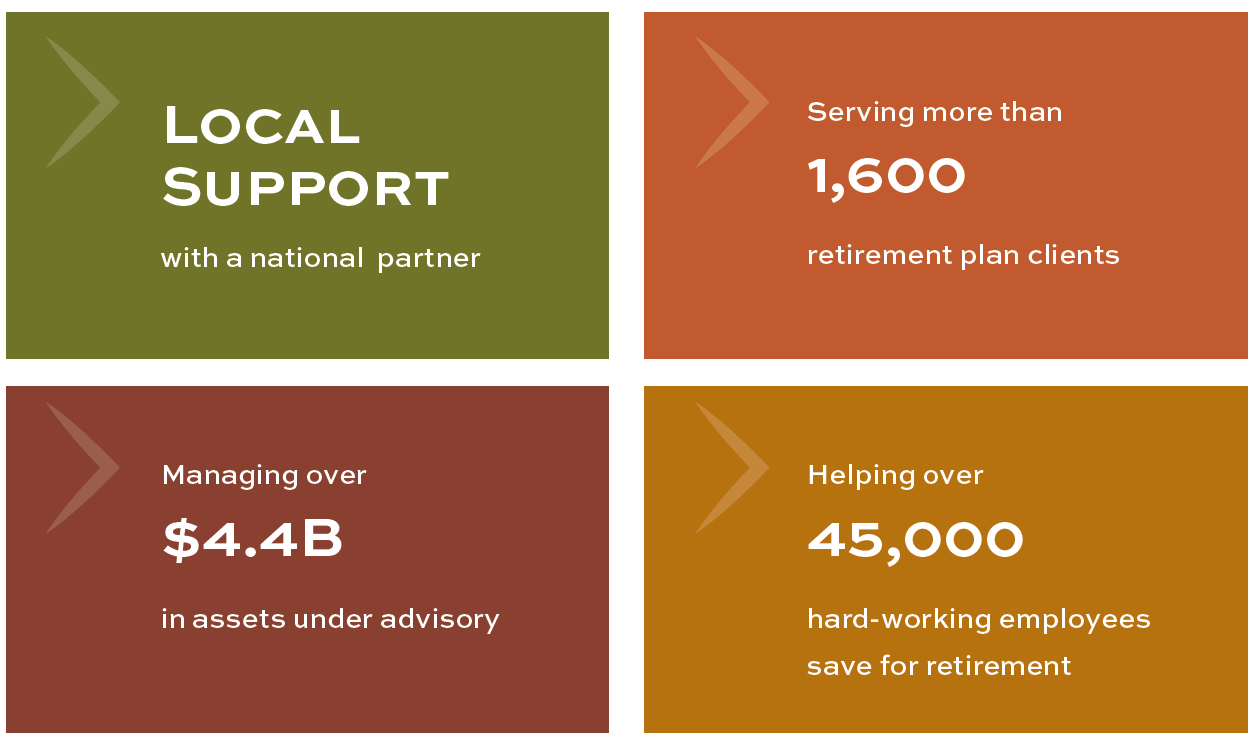

Become part of something bigger

Copper Leaf Financial leverages the support of Buckingham Strategic Partners (BSP). The

targeted support and day-to-day resources provided by BSP means advisors at Copper Leaf

can remain focused on the needs of you and your employees and constantly strive to provide

service that exceeds your expectations.

Most of all, you will enjoy a confident client experience that comes from working with an

advisor who is part of a group that serves more than 1,500 retirement plans and is helping

over 50,000 Americans on their journey to retirement.

Buckingham Strategic Partners, 2021, COMPREHENSIVE RETIREMENT PLAN ADVICE

Resources

Retirement Plan Resources

Related Services

Do something wise today

Schedule a time for a free consultation.