IRAs and Roth Conversions

To enjoy the retirement you’ve always envisioned, it’s important to decide how you will contribute to a traditional Individual Retirement Account (IRA) or Rother IRA account. Your team will help design your unique wealth strategy by discussing relevant wealth planning elements such as your retirement, tax minimization and estate.

What You May Be Thinking

- Is a traditional or Roth IRA best for me, or should I have both?

- How much can and should I invest in an IRA?

- How do I know if I should convert my traditional IRA into a Roth?

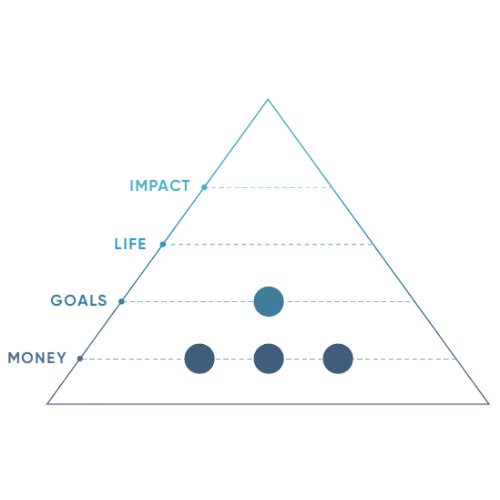

IRAs and Roth Conversions are related to these other areas of planning used by Copper Leaf:

How Your Team Helps

There are many complexities surrounding IRAs. Your advisory team works with you to determine how the best fit into your overall wealth strategy. Your team helps you choose the correct IRA by analyzing several factors – your current tax bracket, your anticipated tax bracket in retirement, number of years to retirement and your asset allocation. We guide you through the even more complicated world of Roth conversions by analyzing the timing and contribution amount. We also help by:

- Working with your tax professional to evaluate and advise how to maximize the selection and/or conversion of your IRAs.

- Knowing the best investments to hold in an IRA to enhance your long-term, after-tax rate of return.

- Working with custodians to make sure withdrawals are done properly so the beneficial tax impacts are extended throughout your lifetime.

- Adhering to the rules surrounding Required Minimum Distributions (RMDs) in order to avoid substantial penalties.

- Avoiding the pitfalls that can come with inheriting an IRA, such as forcing the entire balance to become taxable immediately.

Please note that the information presented in this material is for general purposes only and should not be acted upon without first seeking professional advice. This material has been authorized by Focus Partners Advisor Solutions (FPAS), and CLF makes no representation or warranty regarding the accuracy of the information provided. It is being used with permission and was originally published by FPAS.

Copper Leaf Financial has established key strategic partnerships with elite financial industry leaders including FPAS. These alliances put us in the optimum position to help clients reach their personal and financial goals while retaining our independence. We are truly independent fiduciaries offering high-level services without being accountable to a large parent corporation unlike many of our competitors who attempt to pick stocks and outsmart the market. As a member of FPAS network of more than 140 independent wealth management firms we have strengthened our ability to help clients make the best decisions by providing them with ideas, insights, and intelligence from industry thought leaders. Through our strategic partnerships we are in a unique position to deliver comprehensive solutions to our clients. This is true wealth management.

©️2024 Focus Partners Advisor Solutions.

All rights reserved. IRN-24-6693