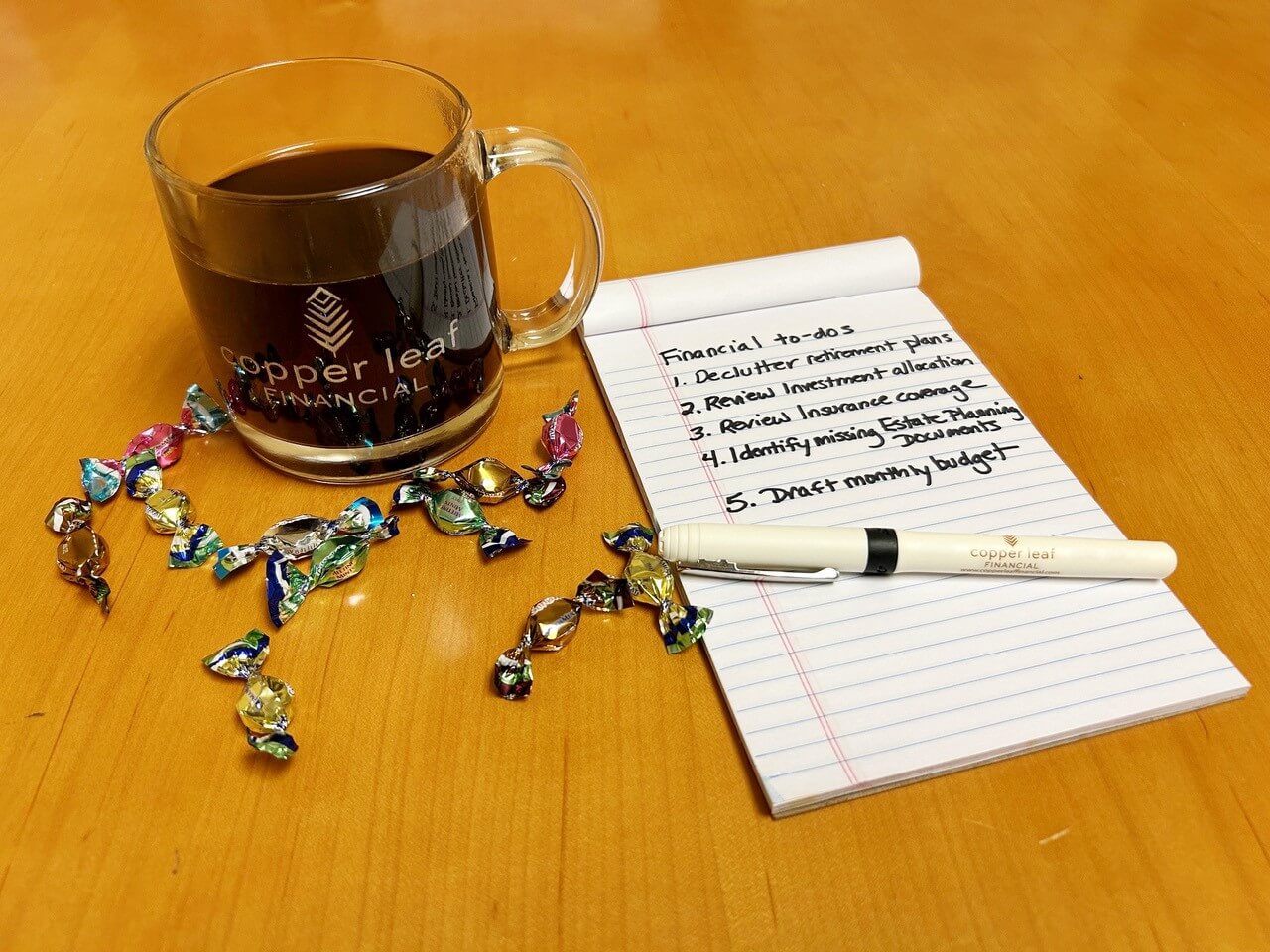

Get Your Financial

“Ducks” in a Row

Any time of year is the perfect time for an annual review of your personal finances!

Financial self-care and well-being mean periodically taking inventory of your finances and the free resources included below can act as your guide!

We recommend that you assess your personal finances annually and it can be done anytime throughout the year – not just as a “new year resolution”.

Read on and learn what you can do this year and beyond to put yourself in a better position to achieve financial well-being and peace of mind. We have included several linked checklists that you may find useful.

Personal Finance Scorecard

To begin, find out how you score on “personal finance preparedness” by completing our brief scorecard. Doing so can help determine what areas need more attention. Perhaps your estate planning is in good order, but your investment planning needs should be addressed more urgently.

Key Points

Your financial advisor can (and should) help you with this! At Copper Leaf Financial we work with our clients to make their list, and we help them complete each task.

Financial goals should align with what matters most to you. This will be different for each person based on age and current circumstances. Furthermore, your priorities will change from year to year.

This can be intimidating for people, but an achievable budget is not as daunting as you might think it is.

Financial Checklist

Getting your finances organized and on track should top your New Year’s Resolutions list. We can help! Below is a short list of to-dos that you should try to tackle EVERY year (and any time of year).

This has important tax and expense considerations. Besides, isn’t it time to cut back on all of that paperwork from multiple plans?

Does your investment allocation line up with your long-term financial plan? Are you well diversified? Are you paying any unnecessary fees? Your asset mix can shift over time due to differences in performance among stocks, bonds, and cash investments. When this happens, your portfolio either has more risk or less potential for growth than you intended. Rebalancing your portfolio – that is restoring it to your target asset allocation – can help keep your investment plan on track. A periodic review also provides an opportunity to consider whether your target allocation is still appropriate for your goals and time horizon.

Homeowners/renters, auto, life, umbrella, disability, etc. Are you under-covered or overly covered? We help our clients collect quotes, negotiate rates, and organize paperwork. Learn more.

Let’s do a thorough review of your advance directives, will, trusts, and medical and financial Powers of Attorney, to name a few. These documents can protect your family! We work with our clients to ensure that they are kept in one central location. Doing so can simplify retrieving the information should something happen to you or one of your family members.

Inflation adjustments to tax brackets can result in slightly more in your paycheck in 2025, so monitor your federal and state withholdings to avoid a tax bill. This is especially critical during major income or life changes. Withhold too much and you can expect a refund, but if you do not withhold enough, you could owe money come tax time.

At Copper Leaf Financial we work closely with our clients to perform these periodic financial reviews. Doing so helps to ensure that proactive adjustments are made which can help you stay on track to meet your goals, especially during times of life changes and market volatility.

Define Your Financial Priorities

Financial goals should align with what matters most to you. Here are some common goals people set, but your priorities may be different:

Aim to save 3-6 months’ worth of living expenses in case of unforeseen circumstances, such as a medical emergency or job loss. This fund should be kept in an account that you can easily access. A savings account, a money market account, and laddered CDs that mature at regular intervals are good choices. An investment account containing lower-risk investments, such as money market funds may also be a good option.

Pay down high-interest debts such as credit card balances or loans and create a strategy for reducing student loans or mortgage debt.

If buying a house is in your near future, start saving for your down payment.

Contribute to retirement accounts such as 401ks or IRAs to help ensure you can live comfortably later in life. If you are already retired, ensure that you are using the most appropriate, tax-savvy distribution strategy.

- High income earners might consider using the backdoor Roth savings strategy – Click here to learn more.

- Business owners and self-employed individuals have unique retirement planning options – Click here to learn more.

Set clear, achievable targets if you’re saving for your child’s college fund or your own education.

- Read more about How to Estimate What College May Really Cost.

For more tips about financial priorities read more in Copper Leaf Financial Senior Wealth Advisor Ashlee Solarczyk’s blog post: “7 Financial Goals for 2025”.

Create a Budget You Can Actually Stick To

Create a budget that is reasonable and achievable for you and your family, so you don’t set yourself up for failure. This can feel daunting, but taking a close look at your expenses and spending habits can lead to greater savings and put you in a better position to achieve long-term financial goals.

Then, assess what “reasonable” amounts are for each type of expense to determine your budget. Categorize spending into fixed costs (mortgage, utilities) and variable costs (dining out, groceries).

- 50% Needs: Rent, groceries, transportation.

- 30% Wants: Entertainment, dining out, hobbies.

- 20% Savings/Debt: Emergency fund, investments, loan repayments.

Put a deliberate pause on nonessential shopping. Try it for a quarter or just 3 months at first and then reassess. For example:

- Pause the purchasing new clothes, accessories, home décor. The occasional thrifting is allowed.

- Allow for take-out or dine-out once or twice a month.

- Plan on the family going to one concert this year not exceeding $100 per ticket.

Checklists

We have the tools to help you get your financial house in order.

Do something wise today

Schedule a time for a free consultation.

Recipients should not act on the information presented without seeking prior professional advice. Check with your advisor about your specific situation or contact Copper Leaf Financial at 802.878.2731.