Why Fiduciary Advice Matters

Being an informed investor can feel overwhelming at times. Your money and your future are at stake so there is a lot to lose, and that is why you need an advisor you can trust and someone who will put YOUR interests first. This is called fiduciary advice. A fiduciary is bound to the highest legal and ethical duty in the investment world.

Unfortunately, it can be difficult for you to know when you are receiving this level of care and when you are not.

Thanks to the Securities and Exchange Commission (SEC) overhaul that occurred in June of 2020 it has become even more difficult to determine if you are dealing with a true fiduciary in that the SEC’s Regulation Best Interest (Reg BI) has actually downplayed the fiduciary standard. Reg BI is meant to ensure that you have enough information to decide whether a professional investment recommendation is best for your needs, no matter who is offering it.

However, Reg BI has taken a “one size fits all” approach when there are two different practices that exist in the financial industry and this has blurred the clarity that once existed between these higher and lesser standards of care.

- “Full-time” fiduciary advisors who offer a fiduciary level of care throughout their relationship with you.

- “Best interest” recommendations which are pieces of advice you may receive during point-in-time transactions.

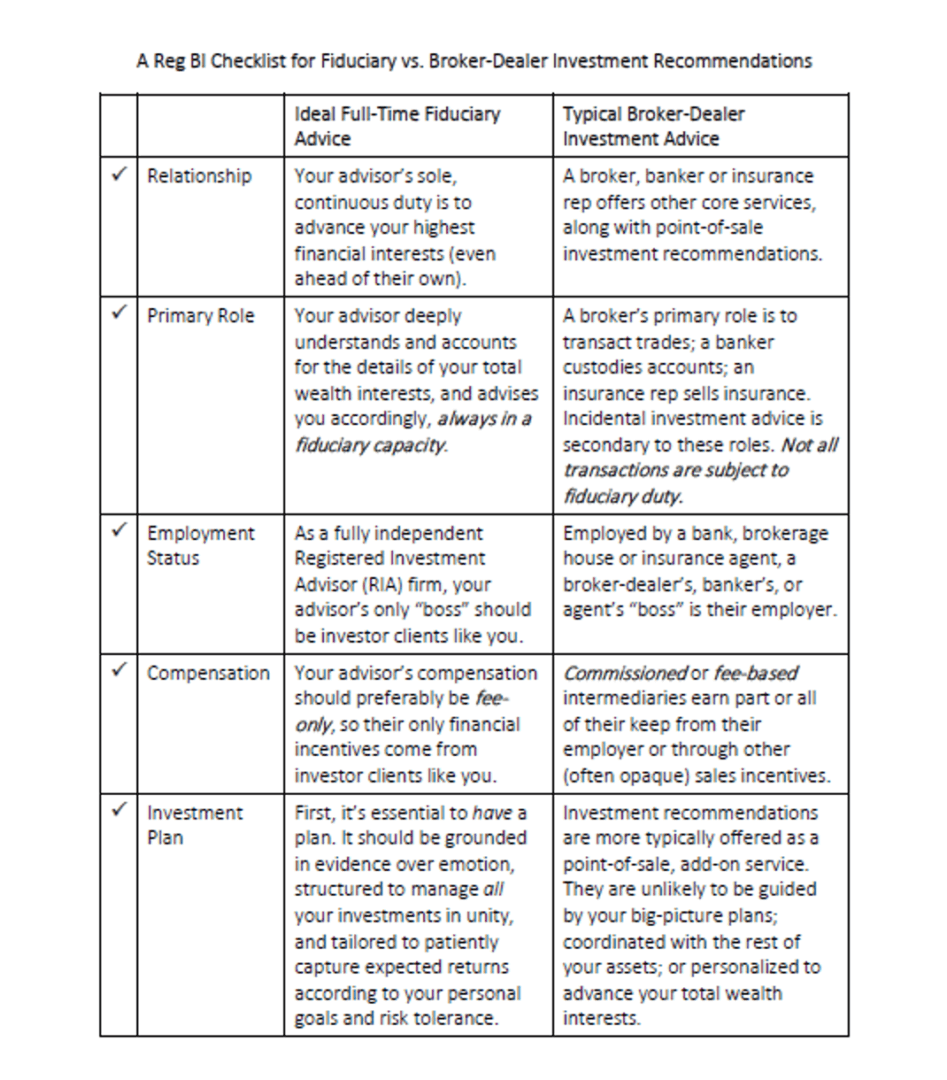

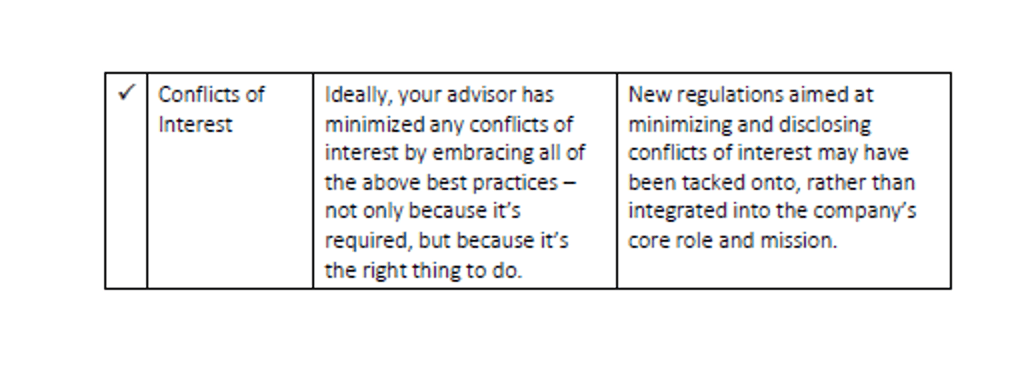

By applying the same broad rules to both practices Reg BI has the potential to overlook the differences between them. Here is a table to use as a handy checklist for evaluating when an investment recommendation is truly in your financial interest and when it is not.

So, what does all of this mean?

There are double standards. Reg BI leaves many legal loopholes for those who wish to continue to offer incidental investment advice. “Best interest” recommendations may still include models that don’t align with your best interests or understanding of your greater financial goals. Leaving you, the investor, to sort out what level of investment advice you are receiving.

Copper Leaf Financial is a member of the National Association of Personal Financial Advisors (NAPFA). We are held to the fiduciary standard which ensures that we act in your best interest. We work with you over the long term and develop a plan that acts as a roadmap – one that evolves over time and reflects changes in your life and goals. Call us today at 802-878-2731 to schedule a strategy session and begin building your road map to financial success. You can also email us at [email protected].

This material has been authored by a 3rd party and CLF makes no representation and takes no responsibility for the accuracy of the information presented.